Die All-in-one-HR Softwarelösung

Erschließen Sie das volle Potenzial Ihrer Mitarbeitenden.

Bessere Mitarbeitererfahrung

Schneller ROI und Support

Verbindung zu über 180 Apps

Konformität und Datenschutz

Rüsten Sie Ihr HR-Team von Tabellenkalkulationen auf Strategie um

Ohne Personio

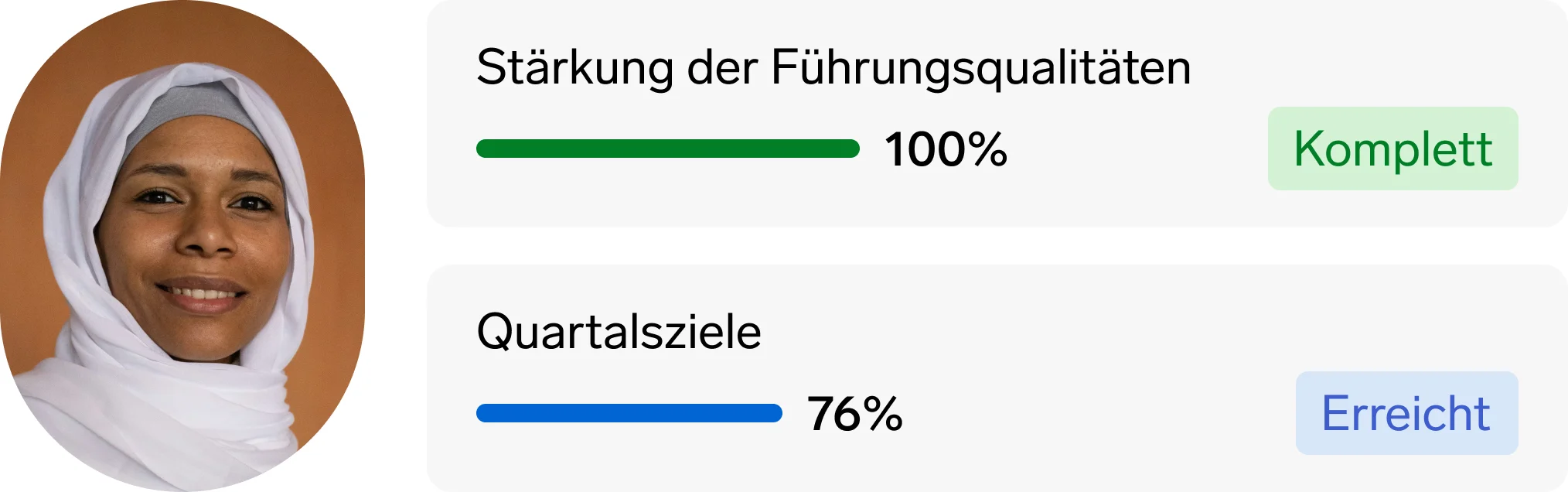

Zunehmende Fluktuation: Die Mitarbeitenden haben keinen Einblick in ihr Wachstum und ihre Entwicklung.

Höhere Kosten: Ineffiziente Arbeitsabläufe und hohe Fluktuation schaden dem Unternehmen.

Überlastung der Verwaltung: HR-Teams haben nur Zeit für Tabellenkalkulationen, nicht für Strategien.

Überholte Datenbanken: Personaldaten werden wahllos gespeichert, was zu Ungenauigkeiten führt.

Mit Personio

Eine gesunde Kultur: Die Mitarbeitenden bleiben motiviert, glücklich und produktiv.

Verlässlicher ROI: Die Automatisierung wichtiger HR-Aufgaben macht Unternehmen effektiver.

Bessere Einblicke: Die Personalabteilung kann datengestützte Perspektiven und Ideen einbringen.

Klare Zentralisierung: Personaldaten werden an einem sicheren, vorschriftsmäßigen Ort gespeichert.

Mehr als 10.000 Unternehmen sehen echte Vorteile

Philipp Rocholl

Geschäftsführender Gesellschafter, Rocholl Garten-, Landschafts- und Tiefbau GmbH

"Die Arbeit im HR hat sich seit Personio nachdrücklich zum Positiven verändert. Alle Prozesse sind viel schneller geworden. Das hilft uns auf dem angespannten Arbeitsmarkt enorm. Seitdem wir das Recruiting über Personio laufen lassen, erhalten wir mehr Bewerbungen."

50%

60h

85%

Sehen Sie Personio in Aktion

Geben Sie Ihre Daten ein und einer unserer Produktexperten:innen wird sich in Kürze mit Ihnen in Verbindung setzen, um einen Demo-Termin zu vereinbaren.

Was Sie erwarten können:

Ein unverbindlicher Einblick in alle Funktionen

Abgestimmt auf Ihre spezifischen Bedürfnisse

Antworten auf all Ihre Fragen

Die Software, die Mitarbeitende lieben:

Kostenlose Webdemo anfragen

Durch Absenden des Formulars bestätige ich, dass ich die Datenschutzerklärung zur Kenntnis genommen habe und mit der Verarbeitung meiner personenbezogenen Daten durch Personio zu den genannten Zwecken einverstanden bin. Im Falle einer Einwilligung kann ich meine Zustimmung hierzu jederzeit widerrufen.